Debt Service Coverage Relation (DSCR) loans are specialized lending options that are often used by investors in real estate and businesses. These loans are distinctly structured to prioritize the borrower’s income relative to their existing debt obligations. DSCR loans are easy for those seeking to expand their portfolios or manage ongoing projects, as they provide financing based on the applicant’s cash flow rather than traditional income documentation.

Understanding the debt Service Coverage Relation (DSCR)

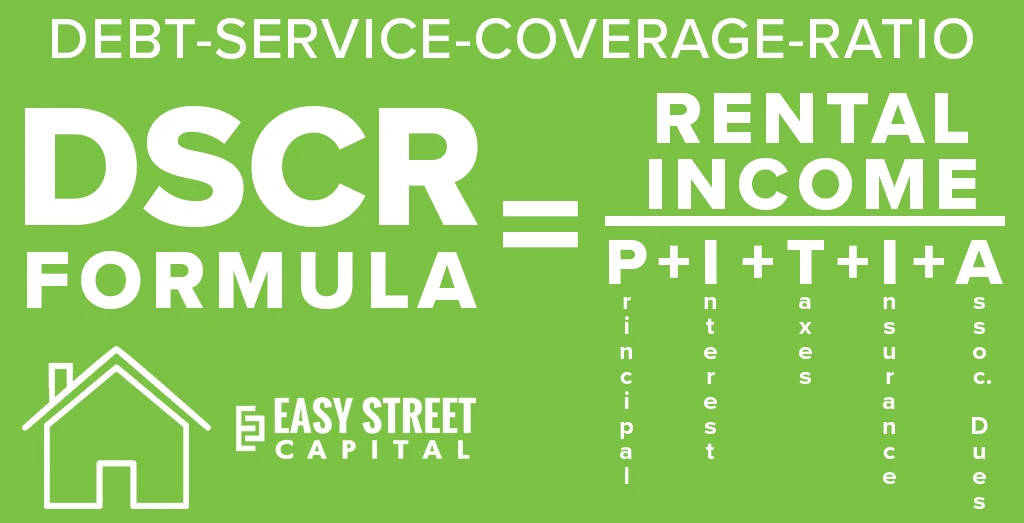

The debt Service Coverage Relation is a financial metric employed by lenders to assess a borrower’s capacity to repay debt. It is calculated by splitting What is Dscr Loan the borrower’s net operating income by their total debt obligations. The result, represented as a relation, provides insight into the borrower’s financial health. For instance, a DSCR of 1. 25 indicates that the borrower has 25% more cash than their debt requirements, which is typically a good border for many lenders.

In the case of DSCR loans, lenders expect the relation to be at least 1. 0, which means that the income generated is sufficient to cover the debt payments. A higher DSCR relation generally demonstrates better financial stability and may cause more favorable loan terms. However, for borrowers with a lower DSCR, the possibilities of getting qualification for a loan may be reduced unless the financial institution takes certain mitigations or more interest rates.

How DSCR Loans Work

Unlike traditional loans that need extensive income documentation, DSCR loans focus on cash flow as the primary determinant of eligibility. Lenders assess a borrower’s DSCR relation by analyzing financial statements and estimated income. This flexibility benefits self-employed individuals and real estate investors who may not have consistent monthly income but do generate substantial cash flow.

DSCR loans are often utilized for real estate investment, as they allow borrowers to leverage the rental income from their properties to qualify. The money flow from these properties helps them demonstrate an acceptable DSCR, enabling them to finance additional investments. These loans also offer competitive interest rates, as they pose a lesser risk for lenders due to the focus on cash flow rather than employment history or personal income.

Advantages of DSCR Loans

Flexibility in Training course

DSCR loans provide an alternative for folks with non-traditional income sources, making them accessible to entrepreneurs and real estate investors.

Less Documentation Required

Since these loans rely on cash flow rather than income documentation, they involve fewer paperwork requirements, streamlining the loan application process.

Potential for Higher Loan Amounts

Borrowers with high DSCR ratios may qualify for larger loan amounts, letting them finance significant investments or large-scale projects.

Appeal to Investors

DSCR loans are particularly advantageous for property investors, as they can use rental income to qualify and potentially expand their portfolios.

Risks Associated with DSCR Loans

While DSCR loans offer considerable benefits, they are not without risks. Borrowers with fluctuating income levels might discover it challenging to maintain the DSCR relation during economic downturns. Additionally, because these loans focus on cash flow, there might be pressure on borrowers to maintain steady rental or business income. A temporary decline in income make a difference the DSCR relation, potentially leading to difficulties in loan repayments.

Who Should look into a DSCR Loan?

DSCR loans are best suited for real estate investors, self-employed individuals, and business owners. This loan type is great for those who generate substantial cash flow from investments but may not have conventional employment income. Borrowers in these categories often find it challenging to qualify for traditional loans due to fluctuating income channels, making DSCR loans an appealing option.

Investors looking to expand their real estate holdings or finance large projects often rely on DSCR loans. These loans permit them to leverage their current cash flow to secure financing without extensive income documentation. For business owners who prioritize growth, DSCR loans provide a flexible solution that aligns with their cash flow-centric financial profiles.

Conclusion

To sum up, DSCR loans are a valuable tool for borrowers who generate consistent cash flow from investments or businesses. By focusing on the debt service coverage relation, lenders assess the borrower’s capacity to manage debt through income rather than conventional employment documentation. With flexible training course criteria and fewer documentation requirements, DSCR loans are an attractive option for real estate investors and self-employed individuals.

While DSCR loans offer notable benefits, they come with risks, especially in fluctuating income scenarios. For those with steady rental income or consistent cash flow, however, these loans provide a practical and efficient financing solution.